"At LPC, our single focus is to help office, retail, and industrial occupiers optimise their accommodation arrangements. A market rent review is one of many lease negotiation events where the tenant's interests must be protected. In certain market review instances, we utilise the services of an independent valuer with a tenant-only focus to ensure the tenant pays the landlord no more than is necessary under the lease. We asked John Rasaku from Rasalan, one of our preferred valuers, to share his insights and case studies that highlight how important it is for a tenant that their participation in a market rent review is fully informed." - Julian Kurath

Get the right advice from the right people to get the right result

“If you want to improve the quality of decisions, you need to improve the quality of information. This means looking beyond the data that is presented to you and seeking out the data that is being hidden.” - Nassim Nicholas Taleb

As a tenant, when you’re faced with a market rent review, it’s important to seek advice from a suitably qualified and independent property valuer. Their advice should be able to help you through what can be a stressful and confusing time, the outcome of which can have long-lasting implications through future option periods (but may also date back to the original signing of the lease, many years earlier). The engagement of a suitably qualified and independent property valuer with aligned interests to yours will go a long way to ensuring you’re not paying any more than absolutely necessary to the landlord, who has a natural advantage in the market rent review process.

While you may be an expert in your field, your landlord is an expert in theirs – property. They’re able to draw on years, if not decades, of collective experience, a comprehensive network, and quite often, information from their own property portfolios to better arm themselves for the market rent review process against tenants.

A suitably qualified and independent property valuer with a tenant-only focus and a diligent work-ethicwork ethic will be able to help you reduce the landlord’s natural advantage.

Case Study 1 – missed incentives

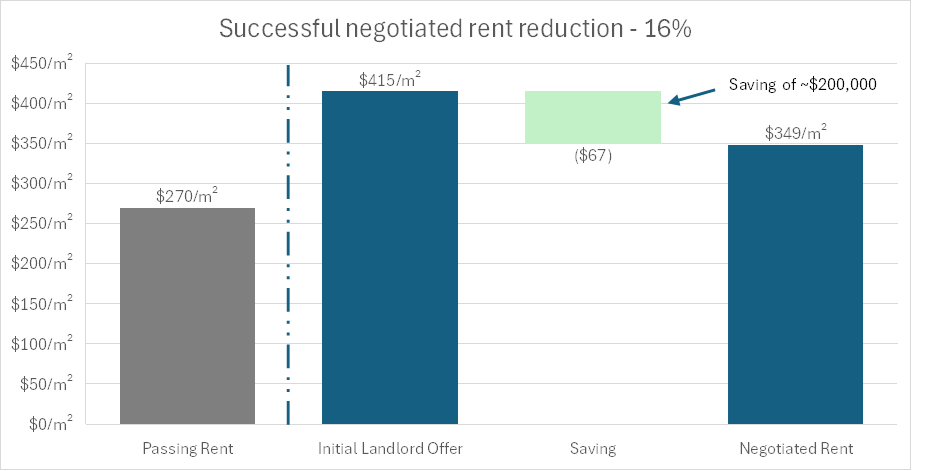

“We were recently engaged by a client who had an upcoming mid-term market rent review and were provided a notice by their landlord reflecting a 53% rent increase. Amongst other things, the landlord’s notice failed to include an incentive component as required by the lease (identified after a thorough review). Our advice helped our client reduce the proposed rental increase by 16% from the original notice.”

In this situation, our review of the lease documentation, coupled with rigorous market due diligence, was able to uncover information previously unknown to our client, critical to helping them achieve a more favourable outcome.

The market rent review process can be stressful and confusing – prevention is better than the cure

Much of the stress and confusion can be traced back years prior, when the original lease was agreed to, along with the time pressures associated with the subsequent market rent review process itself.

The lease outlines the process and can include at-times jargonistic and somewhat confusing language, often requiring clarification from property professionals or indeed even legal advice. Generally, the lease includes specific guidelines that must be adhered to, along with a defined process that must be strictly followed. These guidelines set out time requirements, along with specific requirements that must be regarded or disregarded in the determination of a market rent.

Unfortunately, the market rent review’s outcome may have long-lasting consequences for your business into future option periods, which may have been a direct result of inadequate advice received at the original lease negotiations, setting up a market rent review clause that may be arguably unfairly landlord-friendly (or tenant-unfriendly).

Accordingly, in addition to engaging a suitably qualified and independent property professional to help with the market rent review process, we strongly encourage this also occur whenever you’re considering entering into a new lease.

Case Study 2 –tenant-unfriendly clauses for up to 20 years of leasing

“An example was a long-term lease originally dating back 10 years ago, with multiple options for another 10 years that had ratchet clauses (ensuring the new rent could never reduce below the current rent – regardless of what the market rent should have been and prevailing market conditions at the time of the review).

Further, there was an onerous requirement to assume that if the improvements had been damaged, destroyed, or rendered inaccessible, for the purpose of the market rent review assessment they were assumed reinstated and made accessible. This was despite the core building being approximately 50 years old and experiencing multiple issues, some of which resulted in damage occurring to the tenant’s customers’ goods that were stored within the warehouse. Furthermore, the lease had no provisions to account for market incentives.”

Unfortunately, in this situation, the tenant had previously agreed to a series of tenant-unfriendly market rent review clauses a decade prior, which had long-reaching consequences, resulting in a significant uplift in their rent, despite the deteriorating conditions of the existing tenancy areas.

The market rent uplift faced by the tenant was further compounded by – as many industrial tenants in metropolitan Sydney have been experiencing over the last several years – significant increases in outgoings expenses, which they’re required to pay, not the landlord.

Gross occupancy cost – payer/tenant beware

As touched on earlier, many industrial leases in metropolitan Sydney are struck on a net basis. Therefore, as the tenant, you’re responsible for paying most, if not all, of the building’s outgoings. The unfortunate byproduct of this is that the landlord isn’t responsible for payments of these amounts and therefore, they may not be appropriately incentivised to manage the building’s outgoings appropriately.

When your lease has been struck on a net basis, it’s important that the outgoings you pay are taken into account when your market rent is being determined (unless otherwise required in the lease). These outgoings can have a big impact on the net market rent.

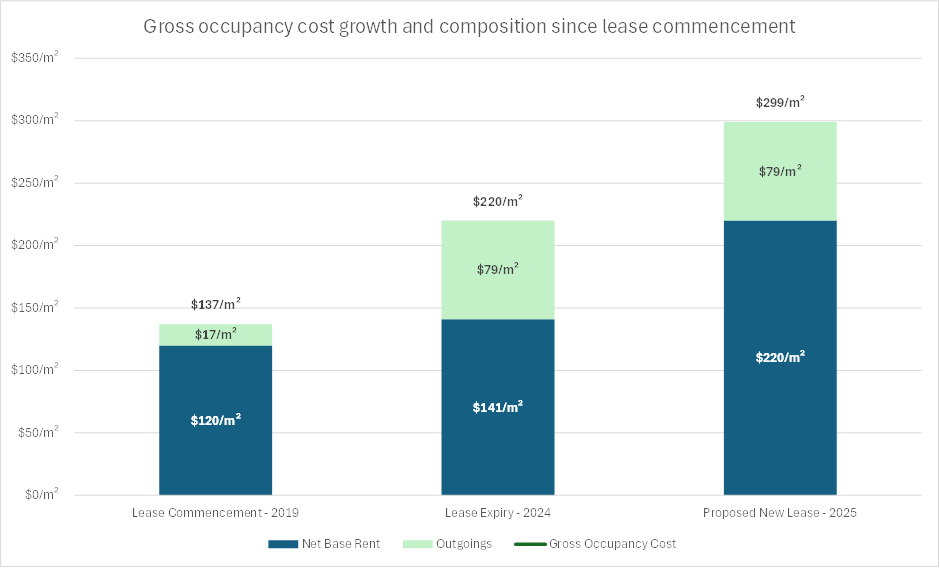

Case Study 3 – gross occupancy costs can get out of hand

“Another recent situation was a client who engaged us because they received a market rent review notice indicating a 56% rent increase to the base (i.e. passing) net rent. Unfortunately, the outgoings for the building had risen significantly since the lease was initially signed by our client, so by the date of the market rent review, the outgoings had increased by 376% over the 5-year period. During the same period, the base net rent had only increased by 17%. Inappropriately landlord-managed outgoings have recently been a big part of increased gross occupancy costs being felt by tenants going through the market rent review process.”

The graph below illustrates the growth in gross occupancy cost over time, with outgoings being a significant contributor.

In this market, most new leases that were being struck on a net basis had outgoings up to approximately $50/m² (a minimum of $29/m² lower than what our client was paying). We are convinced that if the landlord were appropriately incentivised, they would have attempted to manage the building’s outgoings more closely in line with the market's outgoings.

Concluding comments

When faced with a market rent review, it's essential to seek advice from an independent, qualified valuer whose sole interest is protecting your position. Engaging the right expert ensures you won’t pay any more than absolutely necessary to your landlord. For reliable guidance tailored specifically to your interests, contact John Rasaku from Rasalan Group at john@rasalangroup.com or +61 449 106 044.

Who is LPC, and how do we help futureproof their accommodation arrangements?

LPC is a conflict-free advisor to commercial tenants across Australia and New Zealand. We facilitate a strategic review of accommodation strategies, represent occupiers to secure the best-fit accommodation arrangements, provide lease management services to multi-site occupiers, and oversee fit-out and relocation for clients. Contact us to help with your accommodation requirements.

Join the movement to strengthen the tenants' voice by subscribing to The Tenants' Voice LinkedIn Newsletter!